Candle patterns can be single double or triple patterns that consist of one two or three candles respectively. Go ahead and bookmark this page No need to be shy.

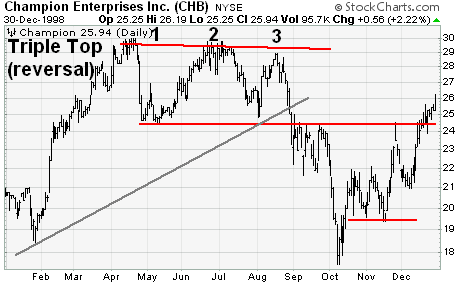

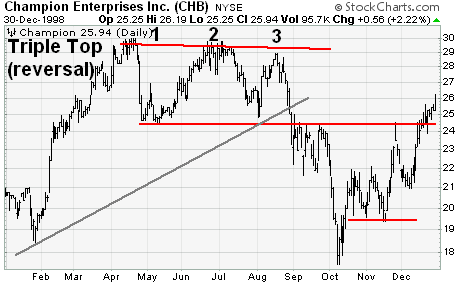

The Complete Guide To Triple Top Chart Pattern

On break-out above the resistance line.

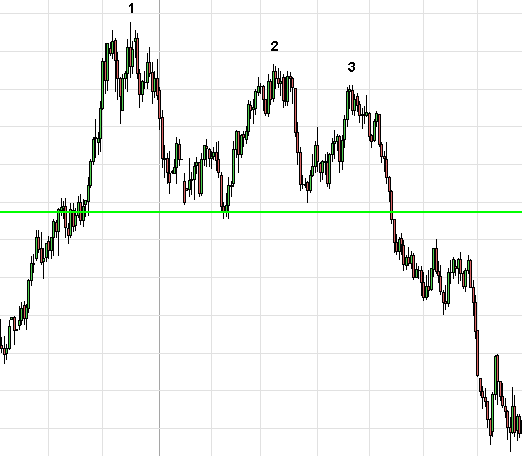

. Similarly the Triple Top shows two unsuccessful tries to continue an upwards trend and signifies a bearish reversal. Download Full PDF Package. The pattern consists of a long red candle that is followed by a long green candle.

This cheat sheet will help you to easily identify what kind of candlestick pattern you are looking at whenever you are trading. How do we trade a Triple Top Bottom pattern. Morning Star and Evening Star reversal The Morning Star candlestick pattern consists of a bearish candle followed by a small bearish or bullish candle followed by a bullish candle which is larger than half of the first candle.

It starts with a bullish candle followed by a. The triple tap pattern shows weakening bullish continuation trend waves. The equivalent bearish.

A double bottom pattern is a reversal indicator that shows a stock has dropped to a key support level. A common bullish candlestick reversal pattern referred to as a hammer forms when price moves substantially lower after the open then rallies to close near the high. The third candlestick is a black body that closes well into the white body.

BlackBerry Ltd BB has created a double bottom and triple bottom patterns on the daily chart. The pattern is made up of three candles. Normally a long bearish candle followed by a short bullish or bearish doji or a small body candlestick which is then followed by a long bullish candle.

It signals a more bearish trend than the evening star pattern because of the Doji that has appeared between the two. The wicks show signs of a tweezer pattern further indicating a rejection at the highs. Black candles indicate falling prices.

Another two-candlestick pattern is the piercing line which may show up at the bottom of a downtrend at the support level or during a pullback. The engulfing candlestick shows a strong bearish push at the third triple tap. On pullback to the.

2 Full PDFs related to this paper. All signs were pointing towards the end of the uptrend. The bearish two black gapping continuation pattern appears after a notable top in an uptrend with a gap down that yields two black bars posting lower lows.

The trading method is akin to the Double Top Bottom chart pattern. The critical aspect of this pattern is that there is a significant gap between the red candles closing price and the green candles open price. If youre REALLY done with those heres a quick one-page reference cheat sheet for single dual and triple Japanese candlestick formations.

Once you identify the confluence factors you may go to a lower timeframe to time. This pattern predicts that the decline. When it appears at the top it is considered a reversal signal.

A short summary of this paper. A single candle pattern involves only 1 candlestick. First is a large white body candlestick followed by a Doji that gaps above the white body.

To have a valid Morning Star formation most traders look for the top of the third candle to be at least halfway up the body of the first candle in the pattern. For a Triple Bottom chart pattern buy. The Evening Star candle pattern is the opposite of the Morning Star pattern.

Triple Top Reversal Chartschool

Chart Patterns Triple Tops Triple Bottoms

What Are Triple Top And Bottom Patterns In Crypto Trading Bybit Learn

Trading The Double Top And Triple Top Reversal Chart Patterns

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-02-f2c3428399574d4181d943daf126cf77.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

0 comments

Post a Comment